dragon of stormwreck isle pdf

Dragons of Stormwreck Isle: A Comprehensive Guide

Discover a fantastic entry point into Dungeons & Dragons, offering a complete adventure readily available as a downloadable PDF!

Explore Sharruth’s Tomb,

with maps and resources from sources like dm-paul-weber’s Tumblr and Reddit communities, enhancing your gameplay experience.

Overview of the Starter Set

Dragons of Stormwreck Isle is meticulously designed as an ideal introduction to the captivating world of Dungeons & Dragons fifth edition. This starter set provides everything a group of new players needs to embark on their first adventure, eliminating the barrier to entry often associated with tabletop role-playing games. The core of the set revolves around a self-contained adventure, “Sharruth’s Tomb,” which is readily available as a complete PDF download from various online resources, including dm-paul-weber’s Tumblr page.

This accessibility extends to pre-generated character sheets, allowing players to jump directly into the action without the complexity of character creation. Furthermore, the set’s content is seamlessly integrated with digital tools like D&D Beyond, and compatible with Virtual Tabletop (VTT) platforms, offering flexibility in how the game is experienced. The availability of printable maps, enemy stat blocks, and initiative trackers – often found as PDFs shared within the online community – further enhances the set’s value and ease of use.

What is Dragons of Stormwreck Isle?

Dragons of Stormwreck Isle is a Dungeons & Dragons starter set specifically crafted for newcomers to the hobby. It’s a complete, standalone adventure designed to teach players the fundamentals of 5th Edition D&D through engaging gameplay. The central narrative focuses on a mystery unfolding on a remote island, where a young dragon’s arrival has stirred unrest and revealed ancient secrets.

Crucially, the entire adventure, “Sharruth’s Tomb,” is often distributed as a convenient PDF, making it easily accessible for download and play. This PDF version, alongside printable maps sourced from Reddit communities like r/stormwreckisle and resources from content creators, allows for both traditional tabletop and virtual play. The set emphasizes collaborative storytelling, problem-solving, and tactical combat, all within a manageable scope. It’s a gateway to a vast and imaginative world, readily available in digital format.

Target Audience and Experience Level

Dragons of Stormwreck Isle is ideally suited for individuals completely new to Dungeons & Dragons, or tabletop role-playing games in general. Its streamlined rules and guided adventure make it an excellent starting point, requiring no prior knowledge of the 5th Edition ruleset. However, experienced players can also enjoy it as a quick and accessible one-shot adventure or a way to introduce new players to the game.

The availability of the adventure as a PDF further broadens its appeal, allowing players to quickly familiarize themselves with the content before a game session. Resources like those found on dm-paul-weber’s Tumblr and community-created materials enhance the learning experience. The pre-generated character sheets included, also often available as a PDF, eliminate the complexity of character creation, making it instantly playable for all.

Contents of the Dragons of Stormwreck Isle Box Set

Unbox a complete adventure, including a rulebook, adventure book (Sharruth’s Tomb), and pre-generated characters, often supplemented by downloadable PDF resources for ease of play!

Core Rulebook Components

The core rulebook within the Dragons of Stormwreck Isle starter set serves as the foundational guide for both new and returning Dungeons & Dragons players. It meticulously details the essential rules of the game, covering character creation, combat mechanics, spellcasting, and the fundamental concepts of roleplaying. Importantly, this rulebook is designed to be accessible, simplifying complex rules for newcomers while still providing enough depth for experienced adventurers.

Beyond the core mechanics, the rulebook introduces the world of Dungeons & Dragons and provides guidance on how to interpret dice rolls and character sheets. Many players appreciate the availability of supplemental PDF documents, often found through community resources like dm-paul-weber’s Tumblr, which offer quick reference guides and expanded explanations of specific rules. These PDFs complement the physical rulebook, making it easier to navigate the game during play sessions. The rulebook is the cornerstone of the entire experience, ensuring a smooth and enjoyable adventure for everyone involved.

Adventure Book: Sharruth’s Tomb

The heart of Dragons of Stormwreck Isle lies within the “Sharruth’s Tomb” adventure book, a meticulously crafted dungeon crawl designed for levels 1-3. This book details the story, encounters, and challenges awaiting players as they explore the mysterious tomb and unravel its secrets. It provides Dungeon Masters with everything they need to run the adventure, including detailed descriptions of locations, monster statistics, and narrative prompts.

Fortunately, for those preferring digital access, a complete PDF version of the adventure is readily available. Resources like dm-paul-weber on Tumblr offer direct links to download the entire adventure PDF and accompanying maps. This digital format allows DMs to easily search for information, annotate passages, and share content with their players. The adventure book, especially in PDF form, is crucial for a seamless and immersive D&D experience, bringing the world of Stormwreck Isle to life.

Pre-Generated Character Sheets

For newcomers to Dungeons & Dragons, Dragons of Stormwreck Isle thoughtfully includes pre-generated character sheets, streamlining the character creation process. These sheets provide ready-to-play adventurers with unique backgrounds, abilities, and motivations, allowing players to jump directly into the action. This is particularly beneficial for those unfamiliar with the complexities of character building, or for groups wanting a quick start to their campaign.

Conveniently, these pre-generated characters aren’t limited to physical copies. They are also available within the D&D Beyond toolset, offering a digital and interactive experience. However, for those who prefer a tangible format, PDF copies of the character sheets can be downloaded directly from the adventure itself, ensuring accessibility and ease of use. Having these PDF sheets readily available simplifies gameplay and encourages immediate engagement with the world of Stormwreck Isle.

Gameplay and Adventure Details

Embark on a thrilling adventure! The Dragons of Stormwreck Isle PDF provides a captivating dungeon crawl, complete with maps and encounters for an immersive experience.

The Island of Stormwreck Isle: Geography and Lore

Stormwreck Isle, a rugged and mysterious landmass, serves as the central location for this introductory Dungeons & Dragons adventure. The island’s geography is diverse, featuring rocky coastlines, dense forests, and the ominous Sharruth’s Tomb – a dungeon steeped in ancient lore. The readily available PDF version of the adventure details the island’s key locations, providing Dungeon Masters with ample material to vividly describe the environment to their players.

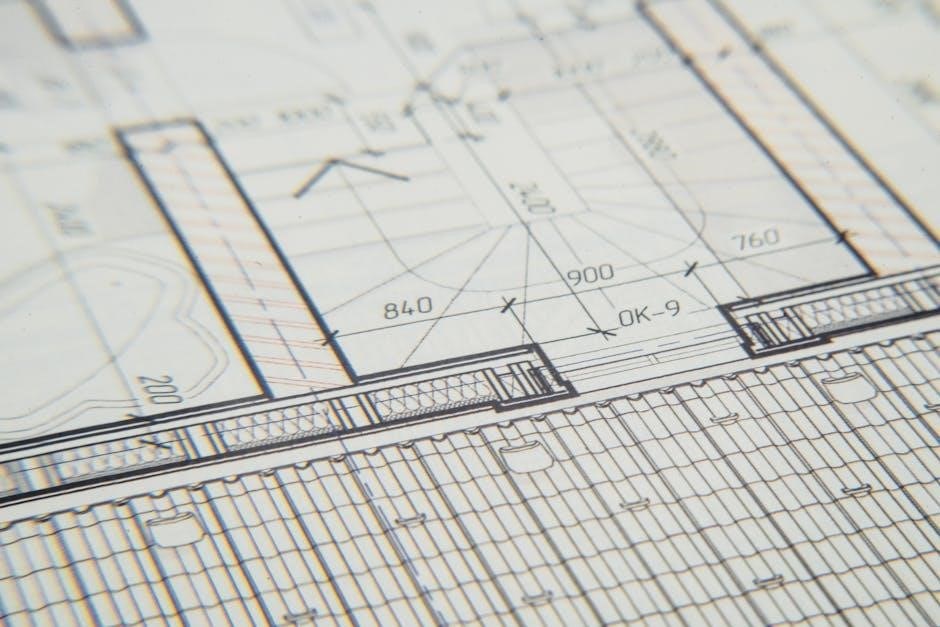

The island’s history is shrouded in mystery, hinting at a past conflict with dragons and the presence of a powerful, ancient evil. The PDF adventure book expands upon this lore, revealing clues about the island’s former inhabitants and the events that led to the creation of Sharruth’s Tomb. Players will uncover fragments of this history as they explore, piecing together the story of Stormwreck Isle and its connection to the dragon threat. Printable maps, often found accompanying the PDF, further enhance the immersive experience, allowing players to visualize the island’s layout and navigate its treacherous terrain.

Sharruth’s Tomb: A Detailed Look at the Dungeon

Sharruth’s Tomb, the core dungeon of the Dragons of Stormwreck Isle adventure, is a multi-level complex brimming with challenges and secrets. The adventure’s PDF provides a comprehensive breakdown of each chamber, detailing its layout, potential encounters, and hidden treasures. Dungeon Masters can utilize these descriptions to create a thrilling and immersive experience for their players.

The PDF also includes valuable resources like enemy stat blocks and initiative trackers, streamlining gameplay and reducing preparation time. Printable maps, frequently shared alongside the PDF on platforms like Reddit and dm-paul-weber’s Tumblr, allow for easy visualization of the dungeon’s structure. Players will navigate traps, solve puzzles, and battle monstrous creatures as they delve deeper into the tomb, ultimately confronting the source of the island’s dragon-related troubles. The detailed descriptions within the PDF ensure a cohesive and engaging dungeon crawl.

Key NPCs and Their Roles

Dragons of Stormwreck Isle features a cast of memorable Non-Player Characters (NPCs) crucial to the adventure’s narrative. The adventure’s PDF details each NPC’s personality, motivations, and potential interactions with the player characters. These characters range from helpful villagers offering quests to enigmatic figures guarding vital information.

Understanding their roles is key to a successful campaign. The PDF provides insights into how NPCs react to different player choices, influencing the story’s progression. Resources shared online, often accompanying the PDF, may offer expanded backstories or roleplaying tips. Players can forge alliances, uncover secrets, or even become adversaries with these NPCs, shaping the fate of Stormwreck Isle. Utilizing the PDF’s NPC descriptions ensures consistent and engaging roleplaying, enriching the overall adventure experience.

Resources and Downloads

Access the complete adventure PDF, printable maps, and enemy stat blocks readily available online!

Find these resources on platforms like dm-paul-weber’s Tumblr and DriveThruRPG.

PDF Availability of the Adventure

The complete adventure for Dragons of Stormwreck Isle, specifically “Sharruth’s Tomb,” is readily available in PDF format for download. This accessibility is a significant boon for Dungeon Masters and players alike, allowing for easy access to the adventure content without needing the physical boxed set. Several online resources host this PDF, notably dm-paul-weber’s Tumblr page, which provides a direct link to a Google Drive file containing the full adventure.

Furthermore, the introductory materials and pre-generated character sheets are also often found as downloadable PDFs. This is particularly useful for those who prefer a physical copy of character information or wish to review the adventure details offline. The availability of the PDF ensures that players can quickly jump into the adventure, whether they are experienced D&D veterans or newcomers to the game.

Additionally, the adventure PDF often includes all necessary maps and supporting materials, streamlining the preparation process for Dungeon Masters. This comprehensive format makes Dragons of Stormwreck Isle an exceptionally accessible and convenient starting point for anyone looking to experience the world of Dungeons & Dragons.

Printable Maps of Stormwreck Isle

Detailed and printable maps of Stormwreck Isle are a crucial component for running the adventure effectively. Recognizing the need for visual aids, the community has actively created and shared these resources. The r/stormwreckisle subreddit, in particular, has been a hub for distributing complete maps of the island in PDF format, often linked to Drive for easy access.

These maps cover various locations, including Dragons Rest, and are designed to be used both for tabletop play and for Virtual Tabletop (VTT) integration. Advents Amazing Advice provides a custom map of Dragons Rest, credited to uchideshi34, further enhancing the visual experience.

The availability of printable maps allows Dungeon Masters to provide players with a clear understanding of the island’s geography and the layout of key locations like Sharruth’s Tomb. These resources significantly contribute to immersion and strategic gameplay, making the adventure more engaging and enjoyable for all participants.

Enemy Stat Blocks and Initiative Trackers (PDF)

Streamlining combat encounters is essential for a smooth gameplay experience, and readily available enemy stat blocks are invaluable. Fortunately, resources exist to simplify this process for Dragons of Stormwreck Isle. Advents Amazing Advice offers a special PDF containing neatly organized stat blocks for all encounters within the adventure.

This PDF doesn’t stop at just stats; it also includes a convenient initiative tracker, allowing Dungeon Masters to easily manage the turn order during combat. A dedicated space is provided to mark hit points (HP), ensuring quick reference during intense battles.

Having these resources pre-prepared saves significant time during sessions, allowing the DM to focus on narrative and player interaction rather than flipping through rulebooks. This enhances the overall flow and enjoyment of the adventure, making combat more dynamic and engaging for everyone involved.

Digital Tools and Platforms

Enhance your Dragons of Stormwreck Isle experience with D&D Beyond integration and Virtual Tabletop (VTT) compatibility, alongside downloadable PDF resources!

D&D Beyond Integration

Dragons of Stormwreck Isle boasts seamless integration with D&D Beyond, a popular digital toolset for Dungeons & Dragons players. This integration provides convenient access to essential game materials directly within the platform. Specifically, the starter set includes pre-generated character sheets that are readily available on D&D Beyond, simplifying character creation and management for both new and experienced players.

However, for those who prefer a tangible experience or require offline access, it’s important to note that you can download and print PDF copies of these pre-generated characters directly from the adventure itself. This flexibility allows players to choose their preferred method of character management, whether it’s through the digital convenience of D&D Beyond or the traditional feel of printed character sheets. The availability of the adventure as a PDF further enhances this accessibility, allowing for easy distribution and use across various devices.

This combined approach ensures that Dragons of Stormwreck Isle caters to a wide range of player preferences, offering a streamlined and adaptable gaming experience.

Virtual Tabletop (VTT) Compatibility

Dragons of Stormwreck Isle is designed with Virtual Tabletop (VTT) compatibility in mind, catering to the growing trend of online Dungeons & Dragons gameplay. Recognizing the need for readily available assets, the community has actively created resources to enhance the VTT experience. A user on Reddit, r/stormwreckisle, has generously shared a complete map set, offering both printable and VTT-ready versions.

These resources significantly streamline the setup process for Dungeon Masters utilizing platforms like Roll20, Fantasy Grounds, or Foundry VTT. The availability of the adventure as a PDF also facilitates easy import of maps and assets into these platforms. Furthermore, the detailed maps of Stormwreck Isle, downloadable from sources like the Reddit community, provide immersive visuals for online sessions.

This commitment to VTT compatibility ensures that Dragons of Stormwreck Isle can be enjoyed seamlessly regardless of your preferred gaming environment, fostering a vibrant and accessible online community.

Community Resources

Explore vibrant online communities like Reddit (r/stormwreckisle) and dm-paul-weber’s Tumblr for PDF maps, resources, and discussions about Dragons of Stormwreck Isle!

Reddit Community (r/stormwreckisle)

The r/stormwreckisle subreddit is a thriving hub for players and Dungeon Masters alike, dedicated to all things Dragons of Stormwreck Isle. This community serves as an invaluable resource, particularly for those seeking downloadable content and collaborative support. Users frequently share links to PDF versions of maps, including complete island maps, often hosted on platforms like Google Drive for easy access.

Beyond maps, the subreddit is a fantastic place to find player-created content, house rules, and advice on running the adventure. Discussions range from character optimization and encounter strategies to sharing battle reports and creative campaign extensions. Newcomers will find a welcoming environment with experienced players eager to assist with any questions. You can discover token sets for virtual tabletop integration and benefit from the collective knowledge of the community to enhance your Stormwreck Isle experience. It’s a dynamic space constantly updated with fresh insights and resources!

Tumblr Resources (dm-paul-weber)

dm-paul-weber’s Tumblr page is a treasure trove of resources for anyone running Dragons of Stormwreck Isle, notably providing direct access to the complete adventure in PDF format. This includes the full “Sharruth’s Tomb” adventure, readily downloadable from a Google Drive link shared on the platform. This is an incredibly convenient resource for DMs who want a readily available, digital copy of the adventure content;

Furthermore, the Tumblr page offers downloadable maps to visually aid in running the campaign. These maps are essential for immersive gameplay and are easily accessible. Paul Weber’s contributions are highly valued within the D&D community, offering a streamlined way to acquire key materials. The page consistently updates with helpful resources, making it a go-to destination for DMs seeking to enhance their Stormwreck Isle campaigns with readily available digital assets and support.

Online Forums and Discussions

Numerous online forums and discussion boards are buzzing with activity surrounding Dragons of Stormwreck Isle, offering a wealth of community-created resources, including links to the adventure in PDF format. Players and Dungeon Masters alike share experiences, tips, and downloadable content, fostering a collaborative environment. These platforms serve as excellent hubs for troubleshooting, campaign ideas, and accessing fan-made materials.

Discussions frequently revolve around optimizing gameplay, sharing character builds, and locating readily available digital resources like maps and stat blocks. Websites like EN World and Reddit’s r/stormwreckisle are particularly active, providing a space for users to exchange information and support. These forums are invaluable for both newcomers and experienced D&D players seeking to enhance their Stormwreck Isle experience and find convenient access to the adventure’s PDF version.